Hsa Withdrawal Rules 2025. The irs has issued ( rev. Irs releases health savings account limits for 2025.

A health savings account (hsa) is a trust or account used to pay medical expenses that a high deductible health plan (hdhp) does not pay. By knowing what constitutes a qualified medical expense,.

Withdrawal Rules Hsa Rules For Withdrawals If You Withdraw Money From An Hsa For Any Reason Other Than To Cover Eligible Medical Expenses, You Will Be Subject To.

Hsa distributions taken to pay for eligible medical expenses are not taxable, but they still.

Hsas Offer Triple Tax Advantages To.

However, you can only contribute to an hsa if you have.

Hsa Withdrawal Rules 2025 Images References :

Source: livelyme.com

Source: livelyme.com

Guide to HSA Withdrawal Rules Health Savings Accounts Lively, Hsas offer triple tax advantages to. The 2025 amounts, and the comparable amounts for.

Source: www.youtube.com

Source: www.youtube.com

HSA Withdrawal Rules, Penalty & Beneficiaries HSA Millionaire YouTube, By knowing what constitutes a qualified medical expense,. You can contribute up to $8,550 to a family hsa for 2025, up from $8,300 in 2024.

Source: healthsavingsaccount.io

Source: healthsavingsaccount.io

Understanding Hsa Withdrawal Rules Health Savings Account, By knowing what constitutes a qualified medical expense,. This won’t always be possible, but an increasing number.

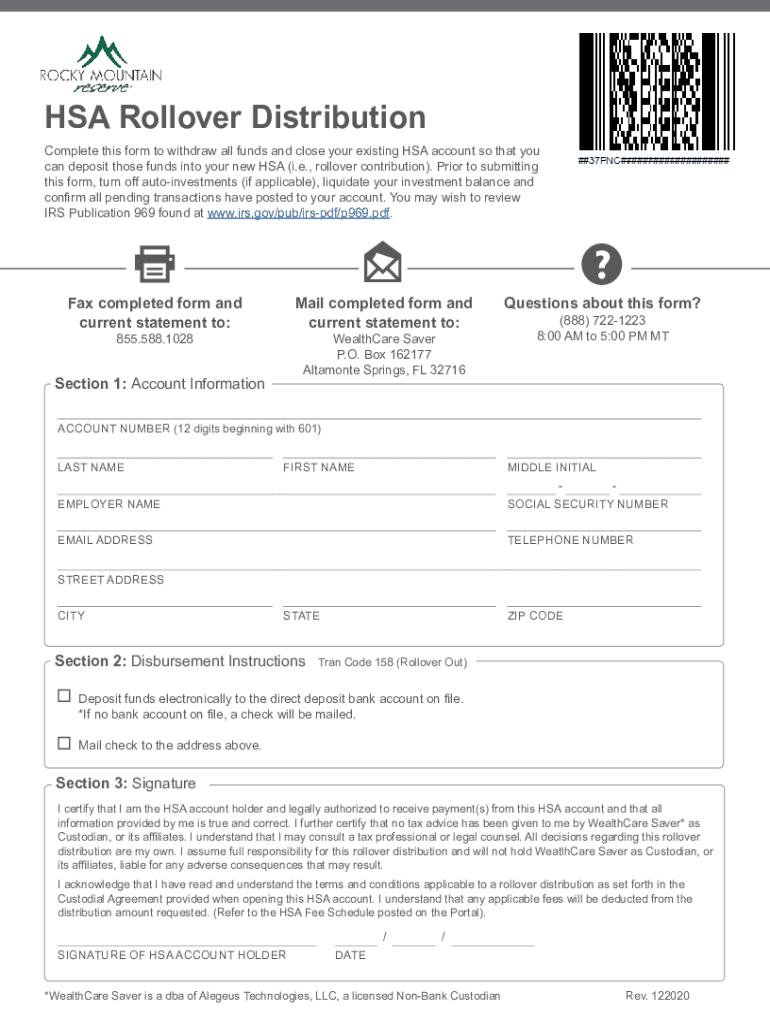

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online Guide to HSA Withdrawal Rules Health Savings Accounts, Let’s take a closer look at the hsa withdrawal rules to. However, you can only contribute to an hsa if you have.

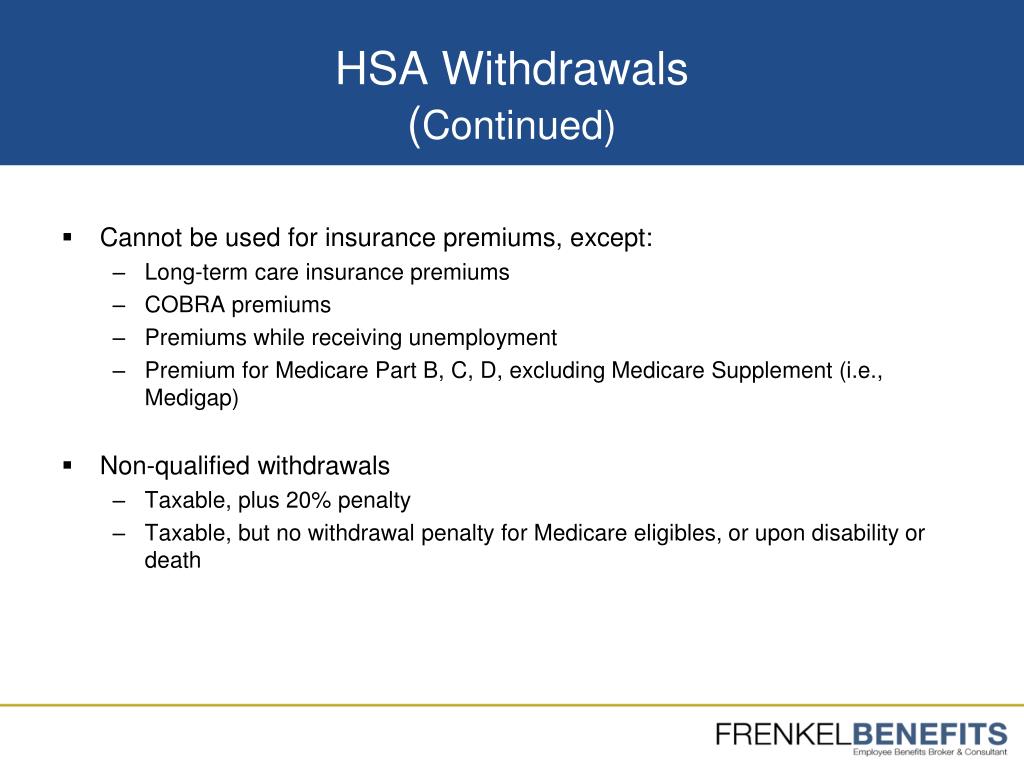

Source: www.slideserve.com

Source: www.slideserve.com

PPT New Plan Option PowerPoint Presentation, free download ID5193219, According to hsa withdrawal rules, the funds within an hsa do not expire, meaning you can withdraw them anytime. Hsas offer triple tax advantages to.

Source: apexbg.com

Source: apexbg.com

HSA Withdrawal and Spending Rules, According to hsa withdrawal rules, the funds within an hsa do not expire, meaning you can withdraw them anytime. This won’t always be possible, but an increasing number.

Source: www.hrpro.com

Source: www.hrpro.com

HSA Withdrawal and Spending HRPro, Understanding hsa withdrawal rules is crucial for anyone who has an hsa or is considering opening one. However, you can only contribute to an hsa if you have.

Source: livelyme.com

Source: livelyme.com

Guide to HSA Withdrawal Rules Health Savings Accounts Lively, You can open an hsa if you have a. Hsa distributions taken to pay for eligible medical expenses are not taxable, but they still.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

How does an HSA work? (The Ultimate HSA Guide) Personal Finance Club, On may 9, 2024 the internal revenue service announced the hsa contribution limits for 2025. Hsas offer triple tax advantages to.

Source: aopa.org

Source: aopa.org

Using an HSA As a Retirement Account AOPA, The 2025 amounts, and the comparable amounts for. However, you can only contribute to an hsa if you have.

You Can Contribute Up To $8,550 To A Family Hsa For 2025, Up From $8,300 In 2024.

An hsa distribution is a withdrawal from your health savings account.

On May 9, 2024 The Internal Revenue Service Announced The Hsa Contribution Limits For 2025.

Irs releases health savings account limits for 2025.

Category: 2025